Personalized Mug - Personalisierte Tasse - Beste Freunde Geschenke - Entfernung bedeutet so wenig, wenn jemand so viel bedeutet -

Joymaking Tasse Geschenk beste Freundin Geburtstag Freundschaft, personalisiert Tasse Geschenk für beste Freundin - Good friends are like stars - 400ml rosa Tasse : Amazon.de: Küche, Haushalt & Wohnen

Geschenke für Freundin, Acryl-Plakette Beste Freundin Geschenke, Personalisierte Geschenk Freundin Geburtstag, Geburtstagsgeschenk Weihnachtsgeschenke für Freundin : Amazon.de: Küche, Haushalt & Wohnen

Personalisiertes 6 beste Freundinnen Bild Poster, Geburtstagsgeschenk – BesteFreundeGeschenke.com - Personalisierte Geschenke für Freundinnen, Freunde, Familie - Bilder, Poster & Tassen.

Prints Digital Prints Freundin Geburtstag Personalisiert Geschenk Schwester Geschenk Beste Freundin Freundinnen Bild Weihnachtsgeschenk Freundinnen Geschenk Art & Collectibles etna.com.pe

Amazon.de: An Meine Freundin - Freundin Geschenk Kerzenhalter, Einseitig Druck, Personalisierte Kerzengeschenke für Frauen, Freundin Geburtstag, Beste Freundin Geschenke (Freundin)

Amazon.de: WUNDERLAND EDITION Beste Freundin Geschenk - Personalisiert mit Sternzeichen und Namen der Freundinnen - Poster, Wandbild zur Freundschaft - Hochwertiger Druck (ohne Rahmen)

2 Beste Freundinnen Poster & Kunstdruck Geschenke personalisiert – BesteFreundeGeschenke.com - Personalisierte Geschenke für Freundinnen, Freunde, Familie - Bilder, Poster & Tassen.

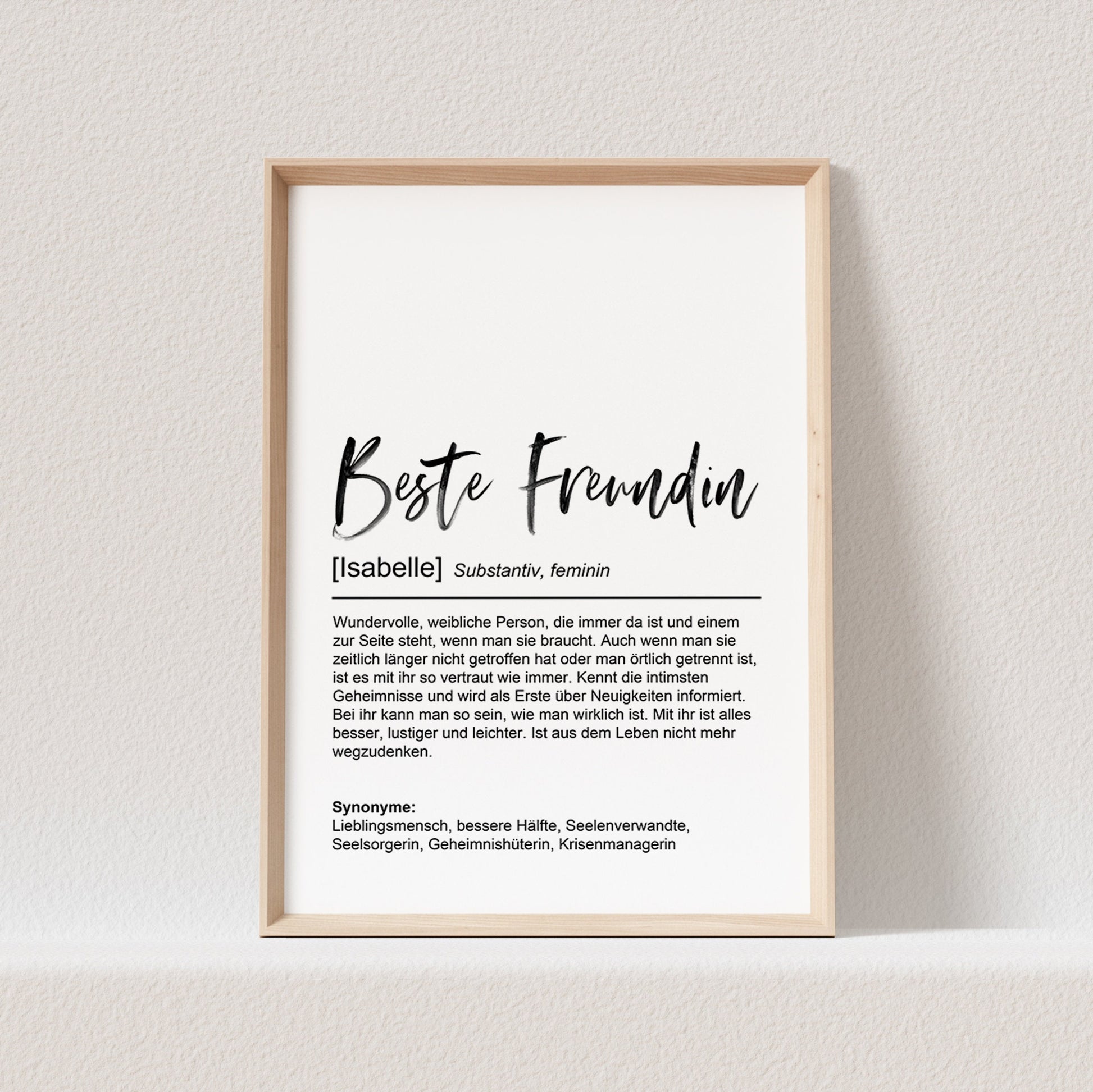

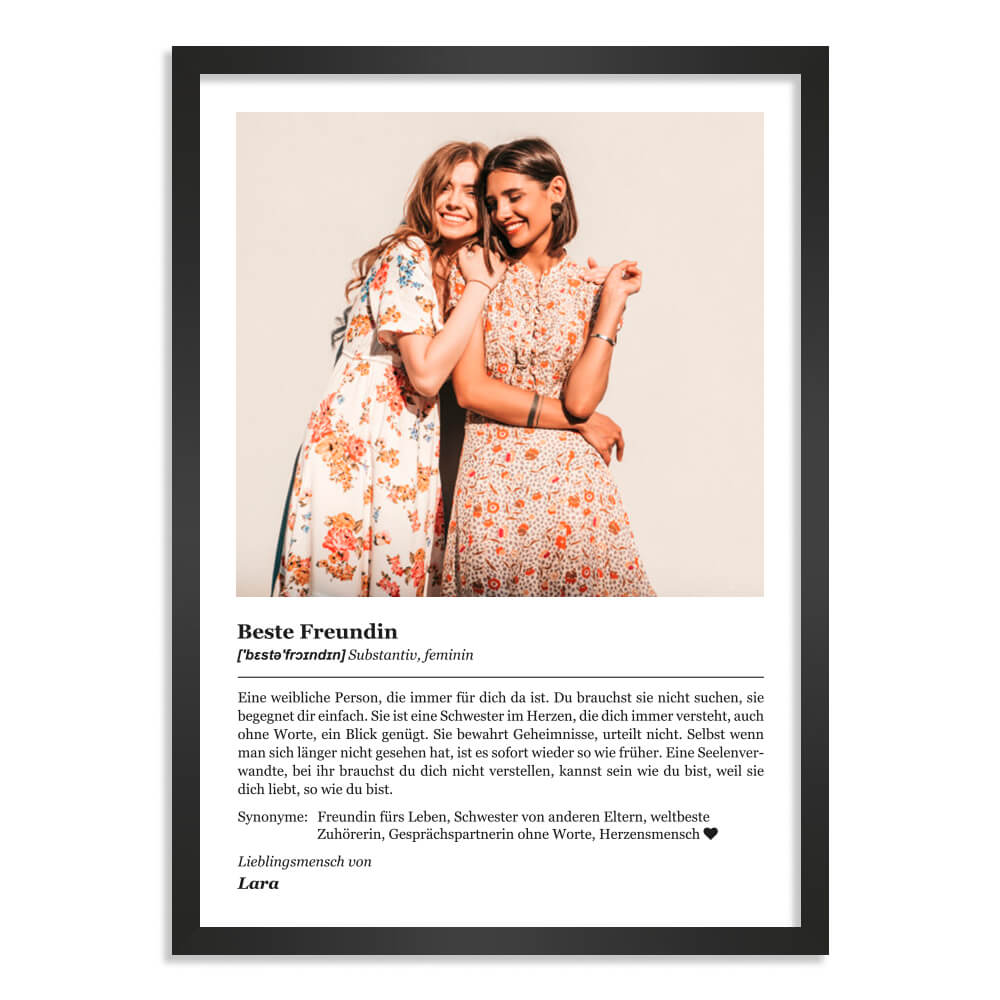

Kunstdruck-Poster Nr. 1 "Definition" als Geschenk mit personalisierter Widmung & Foto - Beste Freundin - DIN A4 | günstig online kaufen - Himmelsflüsterer.de

Personalisierte Freundschaftsgeschenke Freundinnen Bilder & Poster – BesteFreundeGeschenke.com - Personalisierte Geschenke für Freundinnen, Freunde, Familie - Bilder, Poster & Tassen.

.jpg)